Wallace Refiners has launched its 2021 Outlook, which offers the most comprehensive coverage of precious metals markets in the new year. Trillions of dollars were pumped into financial markets in 2020 and that won’t come without consequences. Economists expect that investors will be Bracing For Inflation in 2021.

As investors looks past COVID-19 and anticipate a rosier economy in 2021, copper finished the year on an up note.

In mid-December the red metal topped at $7,964 a tonne, an eight-year high.

Goldman Sachs is bullish. Its analysts say the current copper bull run could continue well into 2022, and the firm estimates that the metal is likely to hit $10,000 per tonne for only the second time in its history.

Metals strategist Nicholas Snowdon said “This current price strength is not an irrational aberration, rather we view it as the first leg of a structural bull market in copper.”

But can copper mines keep up and what are the sources of new supply?

In 2020, copper production will drop. According to the industry experts, global copper supply will likely to fall by approximately 257,000 tonnes, a 1.2% decline compared to 2019, with most affected countries being Peru (14.5%), Australia (7.5%) and Mexico (4.5%).

However, the global copper mining industry is expected to increase copper output by 1.36Mt to 21.4Mt in 2021, with most of the growth coming from Peru (315,000t), Chile (175,000t), United States (112,000t) and China (82,000t).

Cochilco said that Chile – the world’s biggest copper producer – is expected to produce 5.82Mt this year, representing an increase of 0.6% compared to 2019. In 2021, production of copper in Chile could reach 5.99Mt. Strong portfolio of projects will contribute to the long-term copper output growth of up to 7Mt/year in Chile.

In 2021, areas of supply growth for copper are also likely to include the Democratic Republic of Congo, Indonesia and Panama.

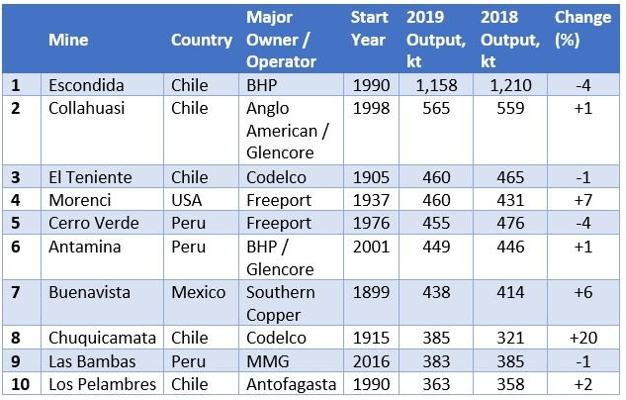

The following is the list of the top 10 largest copper mines in 2019 that will have a significant impact on the overall long-term state of the global copper industry, ranked by production. Five of them are located in Chile, three in Peru, one in the US and one in Mexico. These 10 mines produced more than quarter of last year’s total copper output.

BHP’s Escondida mine continues to be the top copper operation worldwide. The mine complex produced 1,158 ktonnes last year (see a table below), or less 4% than in previous year.

Jointly owned by Anglo American and Glencore Collahuasi mine, also in Chile, sits second with 565 ktonnes of copper mined in 2019.

Third largest copper mine is also in Chile. Codelco’s El Teniente mine produced 460 ktonnes of copper and this volume was on par with output at Freeport-McMoRan’s Morenci mine in USA that jumped three positions up in the ranking.

Chuquicamata, another Codelco’s mine in Chile, increased copper output by remarkable 20% and returned to the top 10 list on eighth position.

Not all copper mines showed strong results in 2019. As expected, Grasberg copper-gold mine that was third largest copper operation in 2018, left the top 10 list in 2019. Production here dropped dramatically by 51% due to depletion of open-pit mining and transitioning to underground operations.

1. Escondida – Chile. 1,158 kt.

Named after the Spanish for ‘hidden’, Escondida is a copper mine located Atacama Desert in Northern Chile and is the world’s largest copper mine by output. Open since 1990, it is one of the deepest open-pit mines in the world. Escondida is majority owned and managed by BHP (57.5%), with Rio Tinto (30%) and Japan Escondida (12.5%) the other joint owners. The mine accounts for about 6% of global copper production.

2. Collahuasi – Chile. 565 kt.

Collahuasi, the second-largest copper operation in Chile and around the globe, is jointly owned by Anglo American (44%), Glencore (44%) and Mitsui (12%). The mine is located at high altitude — between 3,000 and 5,000 metres above sea level. Most of the concentrate produced at Collahuasi is sold to smelters in China for further refining.

3. El Teniente – Chile. 460 kt.

El Teniente is currently the world’s largest underground copper mine and one of the largest by reserve size. It is located about 2,300 metres above sea level in the Andes of central Chile. Chilean state copper miner Codelco, which owns and operates El Teniente, plans to boost production at the mine to more than 500,000 tonnes per year by 2025.

4. Morenci – USA. 460 kt.

Located 16km south of Silver City, Arizona, Morenci is the largest copper mine in North America. It is jointly owned by Freeport and Sumitomo, with Freeport being the majority owner and operator. Last year production at the open-pit mine fell to 431,000 tonnes, a 7% drop from 2017.

5. Cerro Verde – Peru. 455 kt.

Another Freeport-owned mine, Cerro Verde is an open-pit copper and molybdenum mining complex located about 20 miles southwest of Arequipa, Peru. Apart from Freeport, other stakeholders of the mine are SMM Cerro Verde Netherlands, a subsidiary of Sumitomo Metal (21%), Compañia de Minas Buenaventura (19.58%), and public shareholders (5.86%).

6. Antamina – Peru. 449 kt.

The Antamina open-pit mine is located in the Andes mountain range, about 270 km north of Lima, Peru. It is jointly owned by BHP (33.75%), Glencore (33.75%), Teck Resources (22.5%) and Mitsubishi (10%). In addition to copper, Antamina is a source of silver, bismuth, molybdenum and lead. The mine is scheduled to cease production in 2019.

7. Buenavista – Mexico. 438 kt.

One of the largest copper mines in the world by reserve, Buenavista, also known as Cananea, is located approximately 35 km south of the US-Mexico border in Sonora state. Owned by Grupo Mexico, it is one of the oldest open-pit mines in North America.

8. Chuquicamata – Chile. 385 kt.

Chuquicamata, one of the largest open pit copper mines and the second deepest open-pit mine in the world, is located 1,650km north of Santiago, Chile. The mine, popularly known as Chuqui, has been operating since 1910. The century-old copper mine is owned and operated by Codelco and forms part of the company’s Codelco Norte division, which includes the Radomiro Tomic (RT) mine found on the same mineralised system.

9. Las Bambas – Peru. 383 kt.

Las Bambas is a joint venture between China’s MMG Ltd. and CITIC Metal Co. Ltd. The open-pit mine contains mineral reserves of 7.2 million tonnes and mineral resources of 12.6 million tonnes. MMG estimates that more than 2 million tonnes will be produced in concentrate in the coming years.

10. Los Pelambres – Chile. 363 kt.

Antofagasta’s Los Pelambres is a copper mine in Chile’s Coquimbo region, 240 km north-east of Santiago. It produces copper concentrate (containing gold and silver) and molybdenum concentrate through a milling and flotation process.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Wallace Precious Metals The author has made every effort to ensure accuracy of information provided; however, neither Wallace Precious Metals nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Wallace Precious Metals and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.