Editor’s Note: Get caught up in minutes with our speedy summary of today’s must-read news stories and expert opinions that moved the precious metals and financial markets. Sign up here!

|

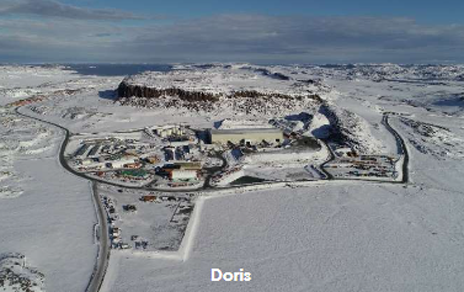

| Image credit: TMAC. |

(Wallace Refiners) – TMAC Resources (TSX: TMR) today announced that the national security review under the Investment Canada Act of the plan of arrangement with Shandong Gold Mining has been extended for a further period of up to 45 days.

The transaction was announced on May 8, 2020. Shandong has agreed to acquire all of the outstanding shares of TMAC at a price of C$1.75 per share in cash.

The total equity value pursuant to the transaction is approximately US$149 million on a fully diluted basis. The offer price represents a premium of 52% to TMAC’s 20-day volume-weighted average price as at May 6, 2020.

TMAC operates the Hope Bay property located in Nunavut, Canada. The property and operations are remote but not isolated, serviced by both a port and airstrip. Hope Bay is an 80 km by 20 km Archean greenstone belt that has been explored by BHP, Miramar, Newmont and TMAC over a period spanning more than 30 years.

TMAC’s gold production was 18,420 ounces during the three months ended September 30, 2020, a 49% decline over Q3 2019.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Wallace Precious Metals The author has made every effort to ensure accuracy of information provided; however, neither Wallace Precious Metals nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Wallace Precious Metals and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.